The transformative power of technology in alternative investments

“57% of Allocators to Hedge Funds are planning to invest in data management in the next 12 months” 2021 Global Investment Survey on Emerging Technologies, Allocator.

Global financial markets have arrived at a watershed moment, with high asset valuations, economic and geopolitical volatility, and investment returns set to stay under pressure for some time to come. While the outlook undoubtedly remains challenging across the investment universe as a whole, a growing number of institutional investors in funds are steadily ramping up their allocations to alternative assets.

So what’s driving the sustained growth trajectory of alternatives? In today’s entrenched lower-for-longer environment, government bond yields have been languishing in negative territory, and many corporate bonds have been following a similar trajectory. With traditional 60/40 portfolios no longer delivering the returns they need, long-term investors seeking to match income with liabilities are fuelling robust – and rising – demand for alternatives. And against this volatile market backdrop, the reduced correlation of alternatives to the stock market holds an obvious appeal for yield-hungry institutions.

Disparate data: overcoming roadblocks to research

Yet even the largest institutional investors can struggle to identify the most attractive investment opportunities in this complex space and then to monitor these positions effectively once invested. Less stringent reporting requirements often obscure transparency, while the lack of public market comparables makes it tough to calculate realistic asset valuations.

Perhaps the biggest challenge facing investors is the difficulty of sourcing, interpreting, and managing investment data from disparate sources, especially when it’s delivered in multiple, hard-to-compare formats. What’s more, the time-consuming, manually intensive task of managing these vast volumes of data is typically delegated to analysts and their Excel spreadsheets. As a result, it stretches internal resources and taking employees away from their day-to-day job ingesting insights, performing due diligence, exercising judgement and making investment recommendations.

Technology is taking over the “heavy lifting”

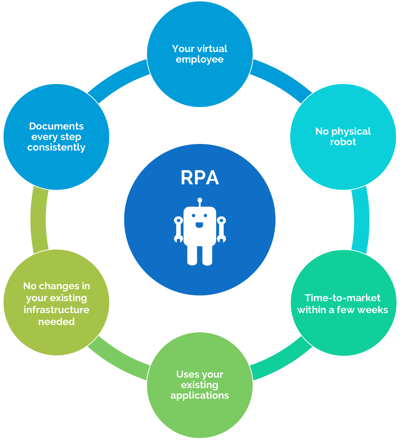

Disruptive new technologies like artificial intelligence (AI) and robotic processing automation (RPA) are increasingly acting as enablers for investors in alternatives, empowering them to drive insightful decision making and enhance operational efficiencies. These technologies take over the “heavy lifting” by deploying automated data gathering to collect unstructured investment data from private fund managers. By aggregating and standardizing that data, these solutions give investors full transparency right across all their investments, including disparate, hard-to-compare funds and portfolio companies. Investors can then draw on that data to make informed and timely investment decisions faster and more efficiently.

Graph 1: RPA benefits, Hedge Think

Extracting maximum value from investment data

In an environment where investors in alternatives need to analyze ever-increasing volumes of portfolio and fund-level data, traditional techniques that rely heavily on time-consuming manual processes and extensive human input are no longer enough on their own. The ability to extract tangible value from investment data and demonstrate that value to their clients is fast becoming a powerful tool to generate outperformance for investors in alternative assets. As a result, growing numbers adopt and implement data management solutions that leverage emerging technologies like AI and RPA.

The future for alternatives

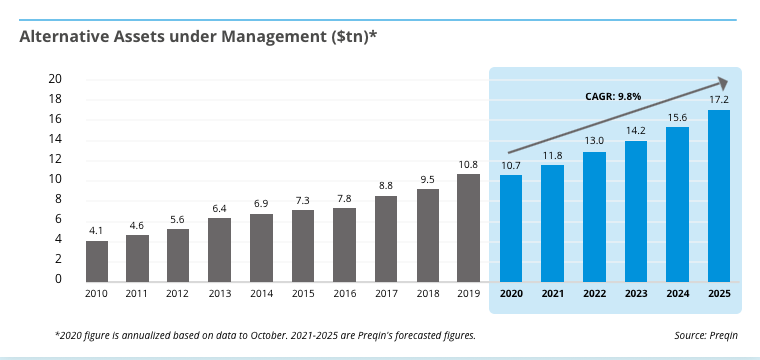

Private markets data provider Preqin predicts that alternative assets will stage a rapid recovery from their temporary COVID-induced slowdown in 2020 – the only year this century in which assets under management registered a decline – to reach $17.2 trillion in 2025.

Graph 2: Alternative assets under management ($bn), 2020 vs. 2025 www.preqin.com/future

Indeed, the pandemic may have taught investors one thing: the vital importance of having a well-diversified portfolio. When the stock market crashed in March 2020, those investors that had diversified their portfolios with alternative assets proved more resilient than those that had not. Crucially, investors with exposure to hedge funds and alternatives were also able to capture a significant chunk of the upside generated from the bounce at the bottom of the market.

With volatility likely to stalk the markets for some time to come, alternative assets look set to play an increasingly influential role in helping investors continue to achieve better diversified, future-proof portfolios that deliver the returns they need. And emerging technologies will be a critical enabler in this drive, giving investors the tools they need to convert incisive, reliable investment data into actionable insights.

In our next blog, we’ll examine the key barriers to emerging technology adoption and the impact of not having a holistic plan that enables firms to improve decision-making and operational efficiency for better performance.