Data Management in Alternatives: Between the ideal and the reality

With growing demand for alternative investments, a new Allocator study reveals a growing latent need for improved data management.

Author, Eric Uhlfelder

Steady returns are key to outstanding asset management. This means much of an Institutional Investor’s attention is dedicated to avoiding drawdowns and avoiding large negative shocks.

Greg Strassberg, head of Aberdeen Standard’s hedge fund risk management team who help safeguard $14 billion of alternative mandates, explains why effective risk management has enabled ASL to sidestep several funds that have soured.

A small/mid-cap activist fund in which his firm was invested was enjoying a sharp rise in assets. Following this rise, Strassberg picked up that the fund’s targets were shifting to much bigger firms, ostensibly to help put more of the fund’s assets to work. This was revealed through factor exposure and price movement sensitivity that were aligning more with large-cap equities, rather than the small/mid-cap strategy ASL had initially committed to.

A fixed-income relative value fund was supposed to be targeting liquid US and European corporate debt. But over time, Strassberg’s team identified the fund’s investments were becoming less liquid and far more obscure thanks to exposure data, introducing risks that were outside the scope for which Aberdeen had underwritten.

And risk management transparency and analysis revealed a diversified global macro fund was making increasingly more concentrated and larger bets, changing the fund’s strategy and risk profile. “While the fund’s performance hadn’t yet suffered by the time we redeemed,” recalls Strassberg, “this clandestine shift in investment strategy reflected a fund that was not for us.”

Strassberg explains risk management is not only essential in identifying the most appropriate managers to fulfil the firm’s various mandates but to ensure they are staying on point after the firm allocates.

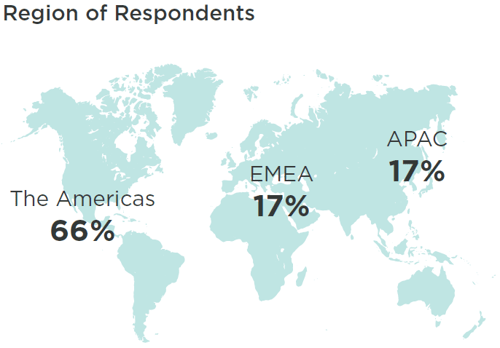

In February 2021, Allocator commissioned a survey of 150 leading global capital allocators which found that Greg’s experiences are not unique to him. With over two thirds of respondents being either sovereign wealth funds, private banks, wealth managers or fund of funds, and just under 65% of them managing over $1 billion of assets, it seems increasing transparency and more closely monitoring manager’s performance and exposure is top of mind for the world's leading Institutional Investors.

Graph 1: Allocator Data Management in Alternatives Survey

The survey found:

- Allocators widely agree enhanced performance requires adoption of improved technological tools to improve data management, especially when blending in various alternative investments in a multi-asset portfolio.

- Improved understanding of portfolio performance, exposure, and risk metrics helps allocators better assess how their underlying managers are responding to changing market conditions and evolving trends; this in turn helps allocators develop sharper investment insights and enhanced decision-making.

- More keen understanding of underlying fund behaviour helps identify managers whose strategies are drifting, altering investment exposure and risk profile.

However, Liam Poole, Chief Operating Officer of Allocator, reports a large number of allocators still commit only limited resources to sophisticated data management software, despite knowing these tools can help allocators improve their performance. Why haven’t we seen far wider adoption?

The answer uncovered by the survey: Cost and a reticence to shift away from established data management methods. Many firms struggle to ascertain the positive and cumulative return on investment in subscribing to such products.

According to Anthony D’Silva, director of Incu Global (an Allocator client) which over the past 8 years has helped emerging hedge funds and funds of funds raise $300 million, says data management systems and technology infrastructure are essential in dealing with the various issues of alternative fund management. At the same time, he believes hands-on qualitative due diligence remains a critical complement to better understand what the data management is revealing.

Liam Poole observes once firms make the financial commitment to data management software, the operational and performance benefits become clearer to clients. When these advantages are recognized, he finds allocators are then more inclined to increase spending on this key facet of asset management.

Allocator’s survey bears this out. It found the majority of allocators interviewed were not meeting their return targets. And yet, virtually the same percentage of allocators surveyed are still seeking greater exposure to alternative investments in the near term.

In looking to expand into the alternatives, again the majority of allocators recognize the need for improved understanding, sharing and assessment of information.

They admit proper investment in technology could reduce operating costs, improve efficiencies, and increase accessibility and accuracy of data to support front-, mid-, and back-office operations.

However, with the main barrier to adopting new technology being costs, personnel training, and significant altering of work processes, the study found only one quarter of respondents want to reduce manual data extraction and note taking and replace them with enhanced automation.

Only one-third of surveyed allocators want greater automation and shifting outsourcing inside to reduce costs and enhance customization.

Allocator believes these contradictory findings reveal a need for better understanding of the ways in which allocators can improve data management, operations, and subsequent performance.

The survey’s bottom line: allocators willing to make the investment show clear interest in improving automated data gathering, processing, and standardization to help obtain timely insights. They seek enhanced access to data across all departments, improved digesting of data in all formats, and a better-informed decision-making process.

Request a demo to learn more about Allocators data management capabilities or reach out to us at: info@allocator.com to learn more about our research and content.