How to find quality companies to invest in Healthcare and Biotech?

2020 has proven to be a volatile year for investment managers due to COVID-19. The emergence of new biotech and healthcare companies have tested their strategies even more than before.

Lockdowns have adversely impacted global markets, and as a result, Allocators have had to weather the storm of turbulent times. Managers have adapted their strategies in finding new ideas, especially in Healthcare, to ensure they continue to provide value for potential investors looking for long term growth in this ever-evolving sector.

With many aspects of everyday life still on hold as the Covid-19 crisis rumbles on, there’s possibly never been greater attention paid to the activities of the healthcare sector as people around the world anxiously await the development, testing and distribution of a safe and efficient vaccine against the virus.

Against this backdrop, Dr Bianca Ogden, Virologist Portfolio Manager at Platinum Asset Management, has provided us with her insight on some of the opportunities available to investors in the Healthcare sector. She has worked previously as a molecular biologist at Johnson & Johnson and Novartis. Her rich scientific base and industry knowledge allow her to delve deep in fundamentals, identifying companies with solid foundations in scientific research. If you want to get more in-depth information on investment opportunities in healthcare, you can watch Dr Ogden’s full presentation HERE.

Trends driving healthcare investments

When many investors think about Healthcare, the idea of pharma firms developing new drugs to combat disease often springs to mind. That’s certainly part of it, but it’s by no means the full picture, and there are plenty of other opportunities to exploit for investors who don’t want to expose themselves to the risks of failing drugs.

Diagnostics is one area that has considerable investment potential. It has really hit the headlines this year as companies have been racing to develop quicker, cheaper, more effective tests and vaccines for Covid-19. And there’s scope for firms to earn considerable sums through better testing as well as vaccines for a wide range of diseases over the coming years.

.png?width=779&name=Vaccines-are-a-great-business%20(1).png)

Vaccines are a great business, source: Moderna Vaccine Day, April 2020

Another exciting area for investors is clinical research organizations. Large-scale clinical trials are a huge undertaking. As a result, many pharmaceutical firms are increasingly outsourcing the legwork to clinical research organizations with expertise in fields such as project management, collecting data and testing drugs. This industry is worth tens of billions of dollars per year and is growing rapidly.

We also see software, analytics and artificial intelligence (AI) grow in importance in the Healthcare sector. For instance, in large-scale clinical trials, software and analytics are playing a vital role in data capture, electronic case reporting and the detection and assessment of drugs’ adverse effects. Meanwhile, machine learning (AI) is playing an important role in how we decode our immune systems. In short, what we’re witnessing is the convergence of biotechnology, AI and information technology.

Companies at the cutting edge

We can’t talk about Healthcare without mentioning some of the exciting areas being researched and the companies that are involved.

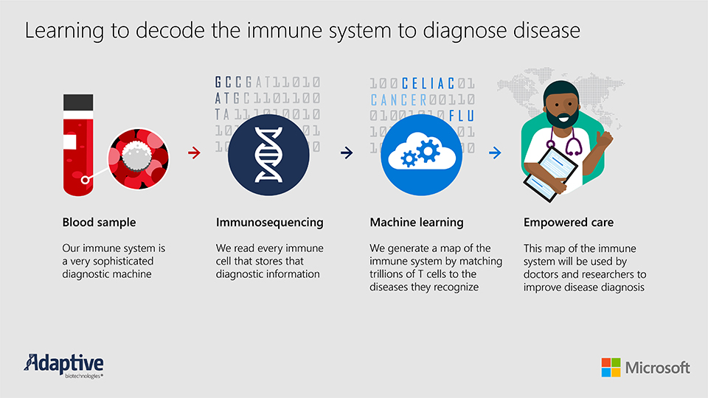

Adaptive Biotechnologies in the US is working in conjunction with Microsoft to analyze our immune system using AI to find out how different diseases are caused. At the moment, it’s looking into the differences between symptomatic coronavirus patients’ immune systems. In other words, those people who have coronavirus but aren’t showing symptoms.

Decoding immune system, source: Microsoft blog HERE

Genomic sequencing has become critical in the study of human disease, and capabilities in this field have increased significantly in the past few years. Illumina, a firm with a USD 50 billion market cap, is generally seen as the company when it comes to sequencing, but it only reads short sections of DNA. However, Pacific Biosciences of California has developed the technology to sequence longer sections of DNA. Its market cap is just USD 2.5 billion, so the scope for it to catch up is straightforward.

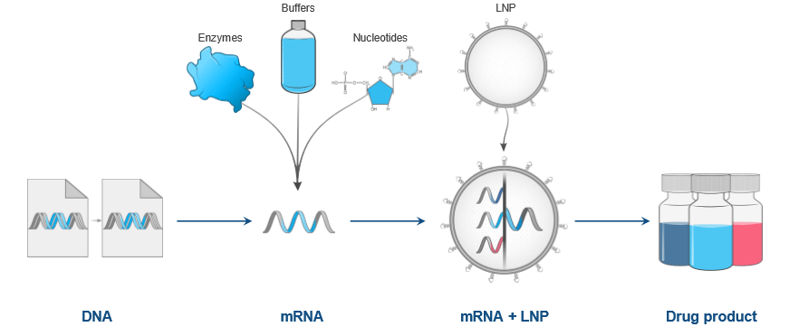

Another area of significant interest is injecting a substance called messenger RNA (mRNA) into the body to instruct our cells to make the proteins that we need to fight diseases. This process is complicated because mRNA tends to be degraded quickly in the body, but many firms, including US biotech company Moderna, are making significant progress in this field. There’s considerable scope for them to be bought out by big pharmaceutical firms.

mRNA manufacturing, source: Moderna Manufacturing and Digital Day March 2020

What do investors need to think about when investing in these firms?

It’s important to remember that standard stock valuation metrics don’t always mean a lot for firms involved in these activities. What’s more important than valuation is that a company has a good pipeline of high-potential drugs. And often, the best firms are those that have failed in the past. If science is right and their people are right, these companies tend to succeed in the long run.

Timing your investment is also a consideration. Most of the excitement and increase in share price tends to occur before a drug or therapy receives approval nowadays. However, it’s important to remember that things can go wrong at any stage for these companies – not just in trials.

How can Allocator help investors research trends and opportunities in the Healthcare sector?

There are a lot of Healthcare funds that report into Allocator. We provide our clients with a range of tools to screen the universe. They can also import information from other databases through the Allocator platform. For investors who are already invested in the Healthcare sector, we’ve got instruments to help them monitor their exposures and provide in-depth attribution of where their performance is coming from. We also receive tens of thousands of pdfs containing company-specific details, and our scraping software enables our clients to search all of them for valuable information on individual firms in the Healthcare universe.

To find out more about how Allocator’s analytics platform can help you analyse Healthcare investment data and get insights into trends in this sector, please contact us at info@allocator.com. You can also watch the full recording of our recent webinar with Dr Bianca Ogden, Virologist Portfolio Manager from Platinum Asset Management on Investment Opportunities in Healthcare HERE.

DISCLAIMER: This article has been prepared by Platinum Investment Management Limited ABN 25 063 565 006, AFSL 221935, trading as Platinum Asset Management (“Platinum”). This information is general in nature and does not take into account your specific needs or circumstances. You should consider your own financial position, objectives and requirements and seek professional financial advice before making any financial decisions. The commentary reflects Platinum’s views and beliefs at the time of preparation, which is subject to change without notice. No representations or warranties are made by Platinum as to their accuracy or reliability. To the extent permitted by law, no liability is accepted by Platinum for any loss or damage as a result of any reliance on this information.