.png)

Volatility is your friend

Author, Hannah Marcheselli

Volatility is top of mind for investors against today’s market backdrop, particularly with inflation and interest rates on the rise. By understanding where volatility can fit within your portfolio, you can learn not to fear it, but to embrace it, says Pierre de Saab, Partner and Head of Asset Management at Dominicé, the Geneva-based specialist investment manager. This article is based on a presentation Dominicé made during a recent webinar hosted by Allocator, weeks before Russia invaded Ukraine. It seems that the global economy has only become more volatile since then.

Navigating the complex world of volatility strategies can be a tricky task for investors, with four main types on the table: passive strategies, systematic strategies, enhanced/smart beta strategies, and actively managed strategies. In the present market environment, it’s this fourth group of strategies that can be deployed strategically to maximum effect in your investment portfolio over the long term.

Actively managed strategies can be broken down into three sub-strategies: one, long volatility/tail; two, short volatility; and three, relative-value volatility. Long-volatility strategies typically buy at-the-money volatility, while the tail-hedge strategies generally buy out-of-the-money volatility. They both deliver regular negative returns in normal market conditions, and significant gains at times of market stress. Based on their negative beta, these strategies act as a hedge for your equity exposure, hence the funding often comes from the equities allocation. De Saab likens long-volatility strategies to five-star hotels: they are very comfortable, but also very expensive.

Short-volatility strategies do the opposite, typically selling volatility. This is like picking up pennies in front of a steam roller: they generate regular positive returns and behave like a long equity exposure, but once in a while, returns are likely to be crushed when volatility spikes Finally, relative-value volatility strategies both buy and sell volatility and are often neutral in terms of their market exposure. These strategies deliver uncorrelated returns and are beta neutral in theory, making them an intuitive bond replacement that can be funded by reducing your fixed income allocation.

Volatility is a bit like salt: you want a little bit in your food, but you wouldn’t want to eat it on its own. It’s important not to look at volatility strategies in isolation, but in the context of your overall portfolio. What’s more, the strategy you choose will depend heavily on your funding. If you have limited capital available, you want a bigger bang for your buck and you're not afraid to have some degree of bleed, a longer-volatility strategy is likely to deliver the best result. Conversely, if you’re prepared to sell part of your fixed income portfolio to fund your volatility strategy, then relative-value is likely to represent the best way forward for you.

So how have actively managed strategies performed over recent years – particularly during times of market crisis?

Chart 1

.jpg?width=600&name=greenshot-2022-03-03-10.40.42_1704x1080_PS_1920x1080_SQ_1280x720%20(1).jpg)

Chart 1 reveals that short-volatility strategies suffered a sharp drop in March 2020 as COVID kicked in, but the drawdown was relatively short-lived. In fact, a look at this index over a longer period would show that these strategies actually rise throughout most of the period covered by quantitative easing - albeit not as quickly as the equity market.

The reverse is true of long-volatility and tail strategies. Long-volatility strategies bled money throughout the bull market until COVID struck. Tail strategies typically bled more in comparison, but their subsequent recovery was faster. The relative-value volatility strategy was also up over the period and was relatively unaffected by COVID, demonstrating its uncorrelated profile.

So why add volatility to your portfolio?

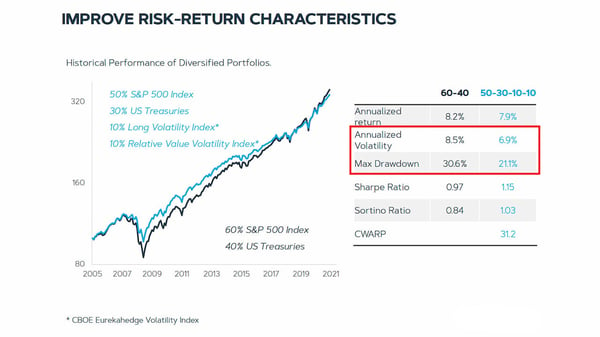

So, based on these unassuming returns, why should you even think about adding volatility to your portfolio? In this simulation below (Chart 2), we took a conventional portfolio comprising 60 percent S&P 500 and 40 percent U.S. Treasuries. We then removed 10 percent of the U.S. Treasury allocation and invested it in a bond replacement—the Relative Value Volatility Index. We also took away another 10 percent from the S&P 500 allocation and invested it in the Long Volatility Index. The simulation shows that while the annualized return remains relatively static, drawdown and volatility are significantly lower.

Chart 2

In other words, adding volatility to your portfolio is less about returns, and more about the power of these strategies to mitigate serious portfolio drawdowns in times of market crisis. The chart below (Chart 3) shows major drawdowns from the subprime crisis right through to COVID: in each one, the balanced portfolio with some volatility strategies outperforms a conventional 60/40 portfolio.

Chart 3

.jpg?width=600&name=mitigate-drawdowns_1712x1082_PS_1920x1080_SQ_1280x720%20(1).jpg)

Why active management really matters

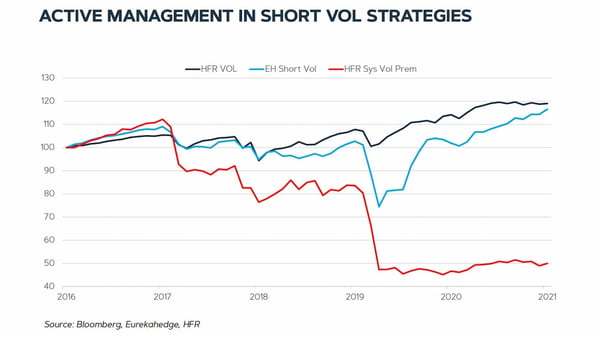

Conventional wisdom dictates that there is no sense in trying to beat the market, so being fully passive is the only intuitive option. But a closer look at the recent performance of short-volatility strategies provides a compelling illustration of the added value that active management can provide (Chart 4).

Chart 4

The red line denotes systematic volatility premia: every time a market shock occurs, a significant amount of money is lost – and not necessarily recouped. Compare this to the Eureka Hedge Fund Index – essentially the active managers: these strategies are also hit hard by COVID. But because they are actively managed, the loss is not as severe and can be recouped very quickly in a world where this type of initial shock is swiftly followed by very high growth.

Diversification is also a key benefit to consider here. In Chart 5, the orange line – the basket of volatility funds - is a testament to the asymmetric returns that can be achieved by having not just a single volatility strategy, but a whole portfolio of them. Interestingly, these RV volatility funds all trade similar instruments, but have very different risk-return profiles, which shows that the manager’s investment process is more important than the derivative instruments he trades.

Chart 5

-1.jpg?width=600&name=diversity-among-similar-rv-volatility-strategies_1720x1144_PS_1920x1080_SQ_1280x720%20(1)-1.jpg)

Choosing the right manager

When it comes to choosing an active manager, forget about looking for the “perfect” candidate: instead, focus on building a portfolio of volatility strategies that have your target characteristics - and a manager with an established track record. The key skill set to look for here is the ability to deliver asymmetric returns through active risk management.

We know the losses are going to be bigger than the gains, but those losses don't happen quite as often, so achieving asymmetric returns is all about tweaking the risk-reward tradeoff. Imagine you’re playing a game where you lose one dollar 99 percent of the time and lose 50 dollars just one percent of the time: you would be winning in terms of asymmetric returns. In other words, an actively managed volatility strategy is demonstrably better than a passive one. Crucially, diversification also reduces manager-specific risk – a far more important consideration than diversification in terms of underlying instruments.

Copyright Eurekahedge 2005 - 2022, All Rights Reserved

You, the user, may freely use the data for internal purposes and may reproduce the index data provided that reference to Eurekahedge is provided in your dissemination and/or reproduction. The information is provided on an "as is" basis and you assume and will bear all risk or associated costs in its use, and neither Eurekahedge nor its affiliates provide any express or implied warranty or representations as to originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for any purpose.

Index Data Usage Notice

All data and content on the Hedge Fund Research® website and in the HFR Database products are for your informational and personal use only. The total return data provided on the HFR website, the HFR Database products, and the reports generated from them are for internal, non-commercial use only. The data is not sufficient, comprehensive enough or approved for use in connection with investment products or instruments. You may not copy, redistribute, sell, retransmit, or make the data available to a third party, or otherwise use it for any commercial or public purpose unless you have a separate written agreement with HFR. You require a written license from HFR to use the HFR data, HFR marks and names and/or HFR Index names, including but not limited to use in connection with investment products and instruments (regardless of whether such products or instruments are based on, linked to or track an HFR Index), the name of investment products and instruments, in prospectuses, marketing and other materials publicly or commercially disseminated, benchmarking purposes, and any SEC, government or regulatory filings. Please contact HFR for additional information at: indices@hfr.com.

Disclaimers

The article reflects Dominicé & Co–Asset Management (“Dominicé”) views and the information provided is not investment advice or otherwise based on a consideration of the personal circumstances of the Addressee, nor is it the result of objective and independent research. The information in the article is not legally binding and is not intended and does not constitute an offer or solicitation with respect to the purchase or sale of any security. The article is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. No reliance may be placed for any purpose on the information and opinions contained in the article or their accuracy or completeness. No representation, warranty or undertaking, express or implied, is given as to the accuracy or completeness of the information or opinions contained in the article by any of Dominicé, its members, employees or affiliates and no liability is accepted by such persons for the accuracy or completeness of any such information or opinions, and nothing contained herein shall be relied upon as a promise or representation whether as to past or future performance. Information and opinions expressed herein are subject to change at any time without notice.

HedgePo Ltd (“Allocator”) does not provide investment advice or recommendations about investments of any kind. The information on this Site is intended for educational, informational, and research purposes only. Allocator does not offer advice regarding the quality or suitability of any investment or of any investment manager and assumes no responsibility or liability for any investment decisions or advice, treatment, or services rendered by any institutional investor, expert panellist, broker-dealer, investment manager, investment professional, or any other person featured on this Site. Prior to making any investment or to hiring any investment manager, the user should consult with its financial advisors to verify pricing and other information and perform thorough due diligence. Investment decisions should not be informed or taken based upon, or the results obtained from, the content provided on the Site. Allocator reserves the right to make any changes to the content on this website.